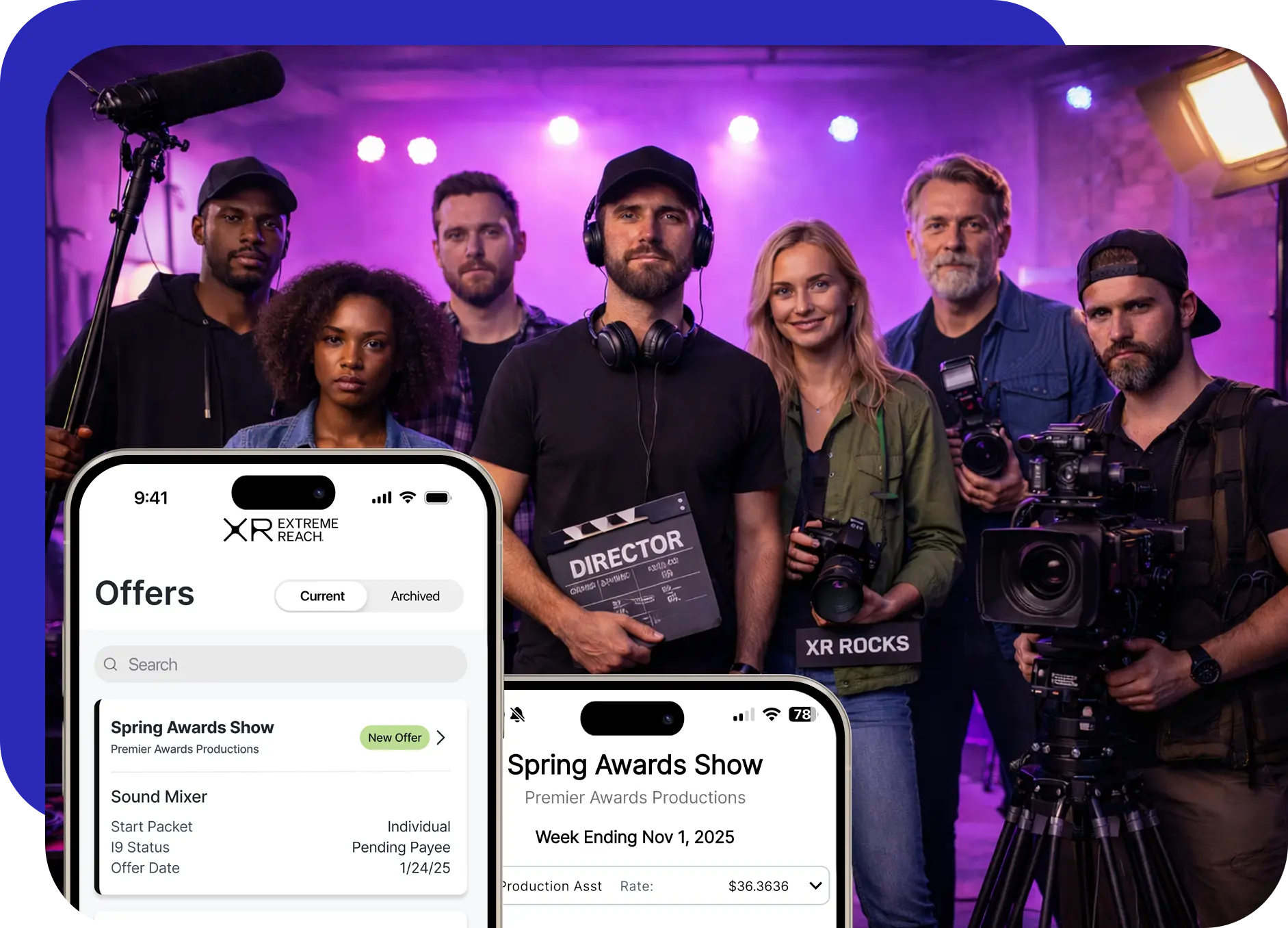

One Trusted Provider for All Production Pay

Delivering the speed, simplicity, and trust in payments for talent in front of the camera and those working behind it.

Where Innovation and Customer Support Go Hand-in-Hand

XR’s people and platform power commercial and entertainment payroll.

Powering Talent Payments

XR handles the heavy lifting for your talent payroll and union compliance, so agencies and brands can move fast knowing every performer is paid accurately and on time. One platform, total peace of mind.

A Complete Crew Payroll Solution

All-in-one platform for commercial crew onboarding, time entry, and payments that integrates easily with your accounting systems. With an intuitive desktop platform for production managers and mobile apps for crews, XR speeds up and simplifies how crews get paid.

Entertainment Accounting, Reimagined

XR Entertainment Pay combines the most tech-forward entertainment accounting software with real industry know-how to keep your productions running smoothly and residuals paid with precision and accuracy.

The Superhero of Production Payments

The World's Biggest Brands Trust XR

Who We Roll With